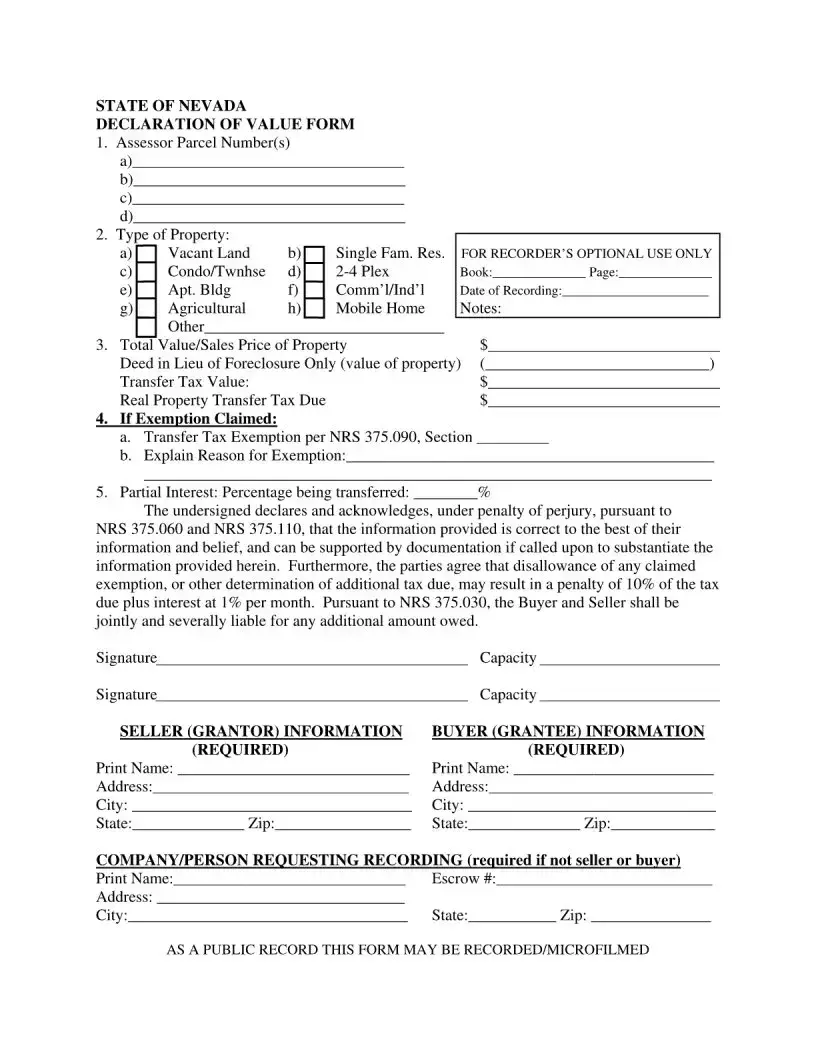

Blank Nevada Declaration Of Value PDF Template

The Nevada Declaration of Value form plays a crucial role in real estate transactions within the state. This document is essential for recording property transfers and provides important information about the property in question. It includes details such as the Assessor Parcel Number, which helps identify the specific piece of property involved. Additionally, the form categorizes the type of property, ranging from vacant land to various types of residential and commercial properties. One of the key components of the form is the total value or sales price of the property, which is necessary for calculating the Real Property Transfer Tax. If an exemption from this tax is claimed, the form requires an explanation and reference to the relevant Nevada Revised Statutes. Furthermore, the document addresses partial interests in property, allowing for the specification of the percentage being transferred. Signatures from both the seller and buyer are mandatory, affirming the accuracy of the provided information under penalty of perjury. This form not only facilitates the transfer process but also ensures that all parties are aware of their tax obligations and liabilities, reinforcing the importance of accurate and transparent real estate transactions in Nevada.

Nevada Declaration Of Value Sample

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Nevada Declaration of Value form is used to report the value of real property during the transfer of ownership. |

| Governing Laws | This form is governed by Nevada Revised Statutes (NRS) 375.060, 375.090, 375.110, and 375.030. |

| Property Types | It covers various property types, including vacant land, single-family residences, condos, and commercial properties. |

| Transfer Tax | The form includes information about the real property transfer tax due based on the sales price or value of the property. |

| Exemption Claims | Claiming a transfer tax exemption requires a valid reason, as outlined in NRS 375.090. |

| Partial Interest | The form allows for the declaration of a percentage of interest being transferred, which is important for shared ownership situations. |

| Liability | Both the buyer and seller are jointly liable for any additional tax owed, as stated in NRS 375.030. |

Fill out Common Forms

Clark County Sales Tax - The document reinforces the legal requirement to report purchases on which no Nevada sales tax was paid, fostering voluntary compliance.

To properly file your corporation's foundational paperwork, the Louisiana Articles of Incorporation form can be obtained from reliable sources, such as UsaLawDocs.com, which provides detailed guidance on completing this essential step for establishing your business under state law.

Nevada 530 - Includes space for a brief statement of facts to support the complainant's case.