Blank Nevada Employment Security Division PDF Template

The Nevada Employment Security Division form plays a crucial role in the process of reporting and paying bond contributions for employers in the state. This form is not just a simple document; it encompasses several important components that ensure compliance with state regulations. Employers must submit their quarterly bond contributions, which are separate from unemployment insurance taxes, to help repay federal loans issued for unemployment benefits. Each quarter, businesses must calculate their bond contributions based on the taxable wages paid, using a specific bond factor assigned to them. The form guides employers through a series of steps, including entering taxable wages, calculating the bond contributions due, and accounting for any late fees or interest that may apply. It also emphasizes the importance of submitting a separate check for bond contributions, ensuring that these payments do not get mixed with unemployment insurance taxes. By following the instructions on this form, employers can fulfill their obligations while helping to maintain the stability of the unemployment system in Nevada.

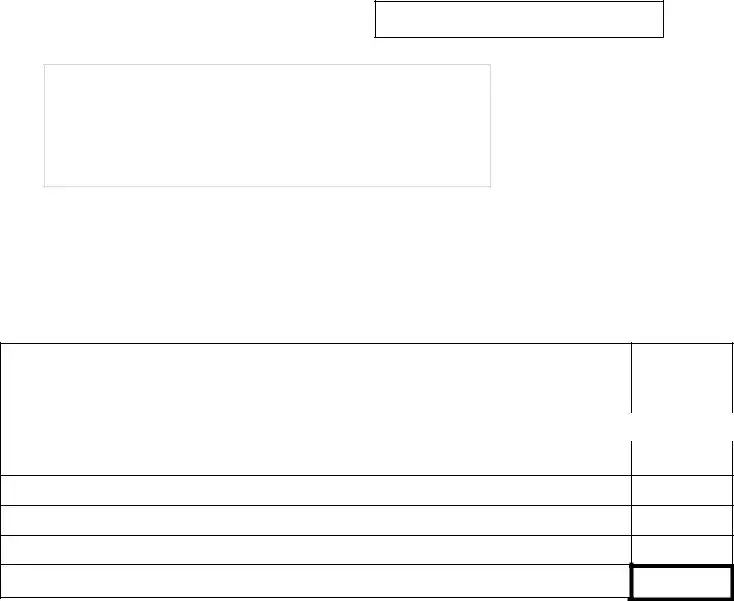

Nevada Employment Security Division Sample

Employment Security Division

Contributions Section

500 E. Third Street

Carson City, NV

https://uitax.nvdetr.org

(775)

Quarter:

Quarter Ending:

Employer Account:

Delinquent After:

BOND FACTOR:

Employer/DBA/Mailing Address

Quarterly Bond Contributions Report

Quarterly bond contributions are due by law in addition to quarterly unemployment insurance (UI) taxes. Bond contributions will continue to be collected quarterly until the bonds issued to pay federal loans for unemployment benefits are fully repaid in late 2017 or early 2018.

Please complete this report to determine the Bond Contributions Amount Due for the quarter stated above.

1.ENTER TAXABLE WAGES PAID THIS QUARTER (Same as LINE 5 on Quarterly Report-

If LINE 5 on

2. |

MULTIPLY BY BOND FACTOR (Your Assigned Bond Factor of .0016, .0029, .0066, or .0089) |

x |

|

|

|

|

|

|

|

|

|

|

|

3. |

BOND CONTRIBUTIONS AMOUNT DUE |

= |

|

|

|

|

|

|

|

|

|

|

|

3a. SUBTRACT CREDIT AMOUNT SHOWN ON BOND BILLING STATEMENT (Equal to or less than LINE 3) -

4. ADD $5.00 FOR ONE OR MORE DAYS LATE FILING THIS REPORT |

+ |

5.ADD ADDITIONAL CHARGE AFTER 10 DAYS (LINE 1 X .001) FOR EACH MONTH/PART OF MONTH LATE+

6.ADD INTEREST ON AMOUNT DUE (LINE 3 X .01) FOR EACH MONTH/PART OF MONTH LATE

7.PAY TOTAL BOND CONTRIBUTIONS AMOUNT DUE (Total LINES 3 through 6)

+

= |

•Return the completed report, along with a separate check for the Total Bond Contributions Amount Due.

Do not combine UI taxes and bond contributions in the same check. UI taxes and bond contributions must be kept separate.

•Make check payable to Employment Security Division. Include your Employer Account Number and “Bond” on the check memo line. NOTE: Electronic payments are not available for bond contributions.

•Use the enclosed return envelope with blue markings. Otherwise, indicate BOND on the envelope.

Print Name of Preparer: ___________________________ Telephone Number: _____________________

BR Rev

File Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to report quarterly bond contributions in addition to unemployment insurance taxes, as mandated by Nevada law. |

| Due Date | Quarterly bond contributions are due by law and must be submitted on time to avoid late fees. |

| Governing Law | The collection of bond contributions is governed by Nevada Revised Statutes (NRS) related to unemployment insurance. |

| Payment Instructions | Employers must submit a separate check for bond contributions, ensuring it is not combined with unemployment insurance taxes. |

Fill out Common Forms

When Must You File a Report of Traffic Accident Occurring in California - The form allows for the inclusion of information on multiple vehicles if more than two were involved.

To ensure compliance with local regulations, businesses should consider utilizing the Louisiana Articles of Incorporation form, which can be conveniently found at UsaLawDocs.com. This form is essential for legal recognition, detailing important information about the corporation's purpose and its officers, thereby solidifying its standing in the commercial landscape.

How to Get a Work Permit in Nevada - The parent or legal guardian must sign the form, granting permission for employment.

Clark County Sales Tax - The Nevada Consumer Use Tax Return embodies the state's effort to collect due taxes while offering guidance to taxpayers for accurate reporting.