Blank Nevada Energy Assistance PDF Template

The Nevada Energy Assistance Program (EAP) serves as a vital resource for households struggling to manage their heating and electric costs. Designed to alleviate financial burdens, this program requires applicants to complete a detailed form that gathers essential information about each household member. To ensure eligibility, the application must include personal details such as names, dates of birth, and Social Security numbers for everyone residing in the home. Additionally, applicants must provide verification of identity for the head of the household, proof of citizenship or legal status, and documentation confirming residency. This can be accomplished through a rental or lease agreement, mortgage statement, or other relevant documents. Furthermore, recent utility bills are necessary to establish current energy costs, along with proof of income for all household members over the past thirty days. This income verification can encompass various sources, including employment wages, social security benefits, and even support from family or friends. Notably, applicants whose expenses exceed their income must also demonstrate how they are managing their financial needs. It is crucial to submit all required documentation, as failure to do so may delay the processing of the application. For those who have previously received assistance, a waiting period of approximately eleven months is mandated before reapplication. As applications are processed in the order they are received, timely submission can significantly impact the assistance received. Interested individuals can mail or fax their completed applications to designated locations in Carson City or Las Vegas, ensuring they include all necessary verifications to facilitate a smooth application process.

Nevada Energy Assistance Sample

IMPORTANT NOTICE

How to Apply for the Energy Assistance Program (EAP)

Submit a completed application (to include the name, date of birth and Social Security Numbers for EVERY PERSON who lives in your home) with the following verification:

1.Proof of identity for the head of household (such as a driver’s license, government issued I.D., school I.D., etc.) and;

2.Proof of citizenship or legal status if born outside of the United States and;

3. Proof of where you live:

a.Provide a complete copy of your rental/lease agreement (listing all persons

in your home) and the signature page, or

b.a copy of your mortgage statement and;

7/21

4.Provide a copy of most recent heating/cooling bills and;

5.When the utility bill is not in the applicant’s name, proof of identity for the individual listed on the utility bill is required along with written authorization for

the applicant to apply, that includes their address, phone number and signature

and;

6.Proof of ALL income for EVERY PERSON in the household for at least the last thirty (30) days.

Examples of types of income: Employment, child support, social security, Veterans benefits, retirement, public assistance, utility reimbursements, unemployment insurance, interest income, money from family and/or friends, or organizations, educational scholarships and/or grants, etc.

Note: If the employed individual is working through an employment agency, provide proof of the last 12 months of earned income.

7.If the household expenses exceed the household income, proof of how the household is meeting their needs.

7/21

**FAILURE TO PROVIDE THIS INFORMATION MAY DELAY THE

PROCESSING OF YOUR APPLICATION. **

Prior year recipients may not reapply until approximately 11 months after they

received their last benefit.

Applications are processed in the order in which they are received. Applicants will receive a notice of decision once an eligibility determination has been made.

Please mail or fax your application and verifications to:

Energy Assistance Program |

Energy Assistance Program |

2527 N. Carson St., #260 |

3330 E. Flamingo Rd., #55 |

Carson City, NV 89706 |

Las Vegas, NV 89121 |

Fax: (775) |

Fax: (702) |

7/21

Division of Welfare and Supportive Services

ENERGY ASSISTANCE APPLICATION

The Energy Assistance Program (EAP) is designed to help eligible Nevada households with their annual heating and electric costs.

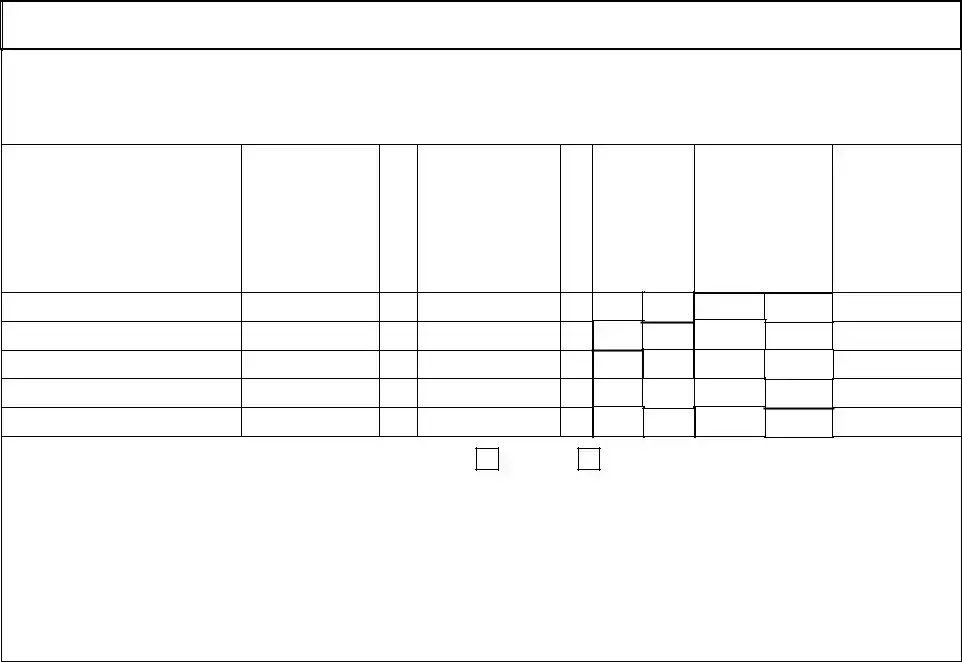

INCOME REQUIREMENTS

The total gross monthly income of all household members may not exceed the amounts shown in the chart below.

YOUR HOUSEHOLD’S GROSS MONTHLY INCOME MAY NOT EXCEED:

Persons in |

Annual |

Monthly |

Home |

Income |

Income |

|

|

|

1 |

$19,320 |

$1,610 |

2 |

$26,130 |

$2,177.50 |

3 |

$32,940 |

$2,745 |

4 |

$39,750 |

$3,312.50 |

Persons in |

Annual |

Monthly |

Home |

Income |

Income |

|

|

|

5 |

$46,560 |

$3,880 |

6 |

$53,370 |

$4,447.50 |

7 |

$60,180 |

$5,015 |

8 |

$66,990 |

$5,582.50 |

(For families/households with more than 8 persons, add $6,810 for each additional person).

Households with a chronic or

(Page A) 2824 – EL (7/21)

BENEFITS

Eligible households receive an annual

credit on the bill.

MINIMUM PAYMENT

WHEN TO APPLY

If your family is not currently on the program and you meet the income requirements, apply NOW.

If you received a benefit during the past 12 months, a notice will be mailed to you when it is time to reapply. If you submit an application prior to the date you’re eligible to reapply, the application will be denied.

WHAT DO I NEED?

Submit a completed an EAP application with the required documentation. Suggested income verifications are noted on the back of this page. To get answers to other questions, call:

Reno/Carson City |

(775) |

Las Vegas |

(702) |

Toll Free |

(800) |

Visit our website at: http://dwss.nv.gov for more information on the program requirements.

You can find information about the Weatherization Assistance Program at:

http://housing.nv.gov/programs/Weatherization/

(Page A) 2824 – EL (7/21)

DOCUMENTATION EXAMPLES OF REQUIRED PROOF OF INCOME

All documentation sent with your application can be either originals or photocopies. If you are unable to photocopy the originals, our office will copy the material and if requested, we will send it back after your case has been processed.

Earned Income: Includes income from employment,

(30)days and how often your get paid, is acceptable. If working through an employment agency or

(Page B) 2824 – EL (7/21)

Unearned Income: Includes income from Social Security Administration, Veterans Administration, pensions, disability, military service, unemployment, child support, alimony, interest, dividends, regular insurance or annuity payments. If you are receiving

Social Security, SSI, Veterans Benefits, pensions, disability income, military income or unemployment: provide copies of the benefit verification form or award letter for the current year showing any cost of living raises. If you are receiving child support/alimony income: provide a copy of divorce decree/separation/settlement agreement or dated letter from the person paying the support (to include name, address and phone number), or a copy of the last check/statement from the child support enforcement agency. If you are receiving interest income/dividends: provide 12 months of bank

account statements, certificates of deposit or other documentation that contains details and is signed by the financial institution, or a broker’s quarterly statement showing earnings.

Cash Contributions and/ or Recurring Gifts: If someone is helping you pay your

expenses or is giving you money: provide a signed statement from each person that includes their name, address, phone number, if the assistance will continue, and the amount provided to you during the last six months. Provide a signed and dated statement by the person providing the money indicating the amount of support, how often it is paid,

when the arrangement began, and whether it is paid directly to a vendor or in cash to you. The statement must include the contributor’s printed name, address(es), and phone

number(s).

(Page B) 2824 – EL (7/21)

Student Income: Includes ALL scholarships and grants, e.g., Pell Grant, Federal Supplemental Educational Opportunity Grant (FSEOG), Veterans Administration

educational benefits. Please provide written confirmation of the amount of assistance, and the educational institution’s written confirmation of the cost for the prior two (2) semesters and summer school (if applicable) of the student’s tuition, fees, books and equipment. If

benefits are paid directly to the student, copies of the latest benefit checks or canceled checks or receipts for tuition, fees, books, and equipment are acceptable.

Public Assistance Income: Includes but is not limited to TANF, county general assistance, Clark County Social Services, or American Indian/Alaska Native General Assistance. Provide a written statement from the public agency with the amount paid during the last month, or a copy of the award letter or check.

PLEASE NOTE: 1099 and

of income.

(Page B) 2824 – EL (7/21)

DIVISION OF WELFARE AND SUPPORTIVE SERVICES

ENERGY ASSISTANCE PROGRAM

MAIL OR FAX OUR APPLICATION TO ONE OF THE OFFICES LISTED BELOW OR EMAIL YOUR APPLICATION TO: ENERGYASSISTANCE@DWSS.NV.GOV

LAS VEGAS / NORTH LAS VEGAS 3330 E. Flamingo Rd., #55

Las Vegas, NV 89121

Telephone: (702)

Fax: (702)

OFFICE FOR ALL OTHER AREAS

2527 N. Carson Street, Suite 260,

Carson City, NV 89706

Telephone: (775)

Fax: (775)

APPLICATION FOR ASSISTANCE

Please complete every section and answer each question. Sign the application and the Rights and Obligations form. Failure to complete all sections and questions and/or sign the application and Rights and Obligations, OR provide the requested documentation noted on the application, will delay processing your application and may result in your application being denied.

(Page 1 of 21) 2824 – EL (7/21)

A. APPLICANT/HOUSEHOLD INFORMATION

Complete the following for every person living in your home, including yourself (attach additional page if necessary). The first name on the application should be the applicant (person listed on the utility bill in the home). Provide proof of identity for the applicant.

|

|

|

|

|

U.S. |

|

|

|

|

S |

|

|

Citizen or |

|

|

|

|

E |

|

|

Eligible |

|

|

Name |

|

X |

Date of |

A |

*Non- |

|

Social |

(Last, First, Middle) |

Relationship |

M/ |

Birth |

G |

citizen |

Disabled |

Security |

(Jr., Sr., III) |

to You |

F |

(mm/dd/yy) |

E |

Yes No |

Yes No |

Number |

SELF

Are there additional people in your home? |

YES |

NO |

|

|

If “YES,” list them on a separate sheet of paper. |

|

|

|

|

Home Address (include apartment or unit number) |

City |

State |

Zip |

|

|

|

|

|

|

Mailing Address (If different from your home address.) |

|

|

|

|

City |

|

State |

Zip |

|

(Page 2 of 21) 2824 – EL (7/21)

File Attributes

| Fact Name | Description |

|---|---|

| Program Purpose | The Energy Assistance Program (EAP) helps eligible Nevada households with annual heating and electric costs. |

| Application Requirements | Applicants must submit a completed application with personal information for every household member, including name, date of birth, and Social Security Numbers. |

| Identity Verification | Proof of identity for the head of household is required. Acceptable documents include a driver’s license, government-issued ID, or school ID. |

| Proof of Citizenship | If born outside the U.S., proof of citizenship or legal status must be provided. |

| Residency Verification | Applicants must provide a copy of their rental/lease agreement or mortgage statement to verify where they live. |

| Utility Bill Documentation | Most recent heating/cooling bills must be submitted. If the bill is not in the applicant’s name, additional documentation is required. |

| Income Verification | Proof of all household income for the last 30 days is necessary. This includes employment, benefits, and any other sources of income. |

| Application Processing | Applications are processed in the order received. Applicants will be notified once a decision is made. |

| Annual Benefit Amount | Eligible households receive a fixed annual credit, with a minimum payment of $240, typically paid directly to energy providers. |

| Reapplication Policy | Prior recipients must wait approximately 11 months after their last benefit to reapply for assistance. |

Fill out Common Forms

Nevada Division of Real Estate - The form also inquires about the association's methodology for calculating and managing the reserve fund, including whether the funds are held in separate accounts.

The Arizona University Application form is a crucial document for students seeking undergraduate admission to Arizona State University, Northern Arizona University, or the University of Arizona. It includes a request for a waiver of the application fee for Arizona residents facing financial hardship. For more information, you can visit https://arizonapdfforms.com/arizona-university-application. Understanding this form and its requirements is essential for a smooth application process.

Nevada Medicaid Renewal - Requires a comprehensive listing of all resources and incomes for the client and/or their spouse, alongside verification.