Blank Nevada Modified Tax Return PDF Template

The Nevada Modified Tax Return form, officially known as TXR-020.05, is a crucial document for businesses operating in Nevada. It is specifically designed for employers who are subject to the Nevada Unemployment Compensation Law. This form must be filed quarterly, with specific due dates that vary depending on the period ending. The form requires businesses to report total gross wages, including tips, paid during the quarter, and allows for deductions related to health insurance and qualified veterans' wages. Calculating taxable wages involves subtracting these deductions from the total gross wages, and the tax owed is determined based on the amount exceeding a threshold of $50,000. Additionally, businesses can claim credits for prior overpayments or other approved credits, further impacting the net tax due. It is essential for employers to file this return even if no tax is owed, as failure to do so may result in penalties and interest. Proper completion of the form ensures compliance with state tax regulations and helps maintain accurate records for financial reporting.

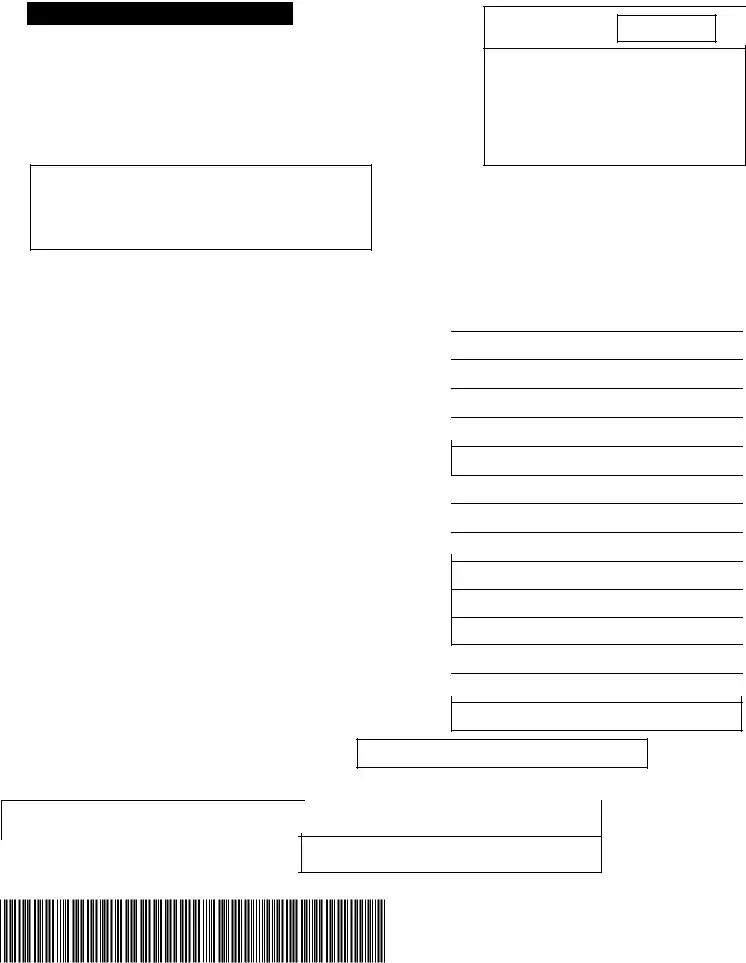

Nevada Modified Tax Return Sample

NEVADA DEPARTMENT OF TAXATION

MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS

Mail Original To: NEVADA DEPARTMENT OF TAXATION PO BOX 52674

PHOENIX AZ

TID

FOR DEPARTMENT USE ONLY

Ending |

12/31/08 |

|

|

|

|

Due on or before |

|

02/02/09 |

Date paid |

|

|

|

|

|

|

|

|

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY

If the address as shown is incorrect, please make any corrections before mailing the return. Use the space on the left for these corrections.

1.TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER (Same amount as on Line 3 of ESD Form NUCS 4072)

2.ENTER DEDUCTION FOR PAID HEALTH INSURANCE/HEALTH BENEFITS PLAN

3.Line 1 minus Line 2

4.Offset Carried Forward from Previous Quarter

5.Line 3 minus Line 4

6.TAXABLE WAGES (If line 5 is greater than zero enter amount here, if less than zero enter on Line 15)

7.CALCULATED TAX (0.63% or 0.0063 x Line 6)

8.CREDITS (Overpayments as determined by the Department)

9.NET TAX DUE (Line 7 minus Line 8)

10.PENALTY (LINE 9 x 0%)

11.INTEREST (LINE 9 x 1% x 0 MONTHS PAST DUE)

12.PREVIOUS DEBITS (Outstanding liabilities)

13.TOTAL AMOUNT DUE (Line 9 + Line 10 + Line 11 + Line 12)

14.AMOUNT PAID

15.CARRY FORWARD (If Line 5 is less than zero (0) enter

amt. here. This Offset will be carried forward for the next quarter)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

MAKE CHECK PAYABLE TO NEVADA DEPT OF TAXATION - A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

Signature

Title

Phone Number |

Date |

|

|

FEIN of Business Named Above

I hereby certify that this return, including any accompanying schedule and statements,has been examined by me and to the best of my knowledge and belief is a true,

correct and complete return.THIS

RETURN MUST BE SIGNED

*020$0123456789$000$12312008*

MODIFIED BUSINESS TAX

Revised 02/10/09

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY (Financial

Institutions need to use the form developed specifically for them,

Line 1. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. (Same amount as on Line 3 of ESD Form NUCS 4072.) DO NOT include a copy of NUCS 4072 with this return.

Line 2. Employer paid health care costs, paid this calendar quarter, as described in NRS 363B.110. Line 3. Line 1 minus Line 2.

Line 4. Offsets carried forward are created when allowable health care costs exceed gross wages in the previous quarter. If applicable, enter the previous quarter's offset here. This is not a credit against any tax due. This reduces the wage base upon which the tax is calculated.

Line 5. Line 3 minus Line 4.

Line 6. Taxable wages is the amount that will be used in the calculation of the tax. If line 5 is greater than zero, this is the taxable wages. If line 5 is less than zero, then no tax is due. (This amount will be entered on line 15 as the offset carried forward for the next quarter.)

Line 7. Calculate Tax Due - Taxable wages x (rate shown on line 7) = the tax due. (Rate Varies by Period End Date according to Tax Laws)

Line 8. Credits - Enter amount of overpayment of Modified Business Tax made in prior reporting periods for which you have received a Department of Taxation credit notice. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used.

Line 9. Net Tax Due - Line 7 minus Line 8. This amount is due and payable by the due date; the last day of the month following the applicable quarter. If payment of the tax is late, penalty and interest (as calculated below) are applicable.

LINE 10- If this return is not submitted/postmarked and taxes are not paid on or before the due date as shown on the face of this return, the amount of penalty due is: a) For returns with Period(s) Ending prior to and including 3/31/07 the Penalty is 10%; b) For returns with Period(s) Ending 4/30/07 and after; the amount of penalty due is based on the number of days the payment is late per NAC 360.395 (see table below). The maximum penalty amount is 10%.

Number of days late |

Penalty Percentage |

Multiply by: |

1 - 10 |

2% |

0.02 |

11 - 15 |

4% |

0.04 |

16 - 20 |

6% |

0.06 |

21- 30 |

8% |

0.08 |

31 + |

10% |

0.10 |

Line 11. Interest - If this return will not be postmarked and the taxes paid on or before the applicable due date, enter 1% (0.01) x (times) line 9 for each month or fraction of a month late.

Line 12. Previous Debits - Enter only those liabilities that have been established for prior quarters by the Department and for which you have received a liability notice.

Line 13. Total Amount Due

Line 14. Amount Paid - Enter the amount remitted with return.

Line 15. Carry Forward - If line 5 is less than zero enter figure here. This amount will be carried forward to the next quarter (offset).

GENERAL INFORMATION:

GENERAL BUSINESSES MUST USE FORM

Who Must File: Every employer who is subject to the Nevada Unemployment Compensation Law (NRS 612) except for

A copy of the form NUCS 4072, as filed with Nevada Employment Security Division, does not need to be included with the original return, but should be available upon request by the Department.

Businesses that have ceased doing business (gone out of business) in Nevada must notify the Employment Security Division and the Department of Taxation in writing, the date the business ceased doing business.

AMENDING RETURN(S):

1.Copy of the original return.

2.The word "AMENDED" written in black in the upper

3.

4.Enter corrected figures, in black, next to/above

5. Enter amount of credit claimed (if any) or amount due.

6.Include a WRITTEN EXPLANATION AND DOCUMENTATION (credit memos, exemption certificates, adjustments to gross wages or health care deductions, etc.) substantiating the basis of the amendment(s).

7.If the amended return results in a credit, a credit will be issued to satisfy current /future liabilities unless a refund is specifically requested.

8.If additional tax is due, please remit payment along with applicable penalty and interest.

The Department will send written notice when a credit request has been processed and the credit is available for use/refund.

Please do not use/apply a credit prior to receiving Departmental notification that it is available.

File Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Nevada Modified Business Tax Return is governed by NRS 363B.115 and NRS 612. |

| Filing Requirement | Every employer subject to the Nevada Unemployment Compensation Law must file this return, excluding certain non-profit organizations. |

| Threshold Amount | The taxable wages are calculated based on a threshold of $50,000, as established by SB483. |

| Due Date | The return is due by the last day of the month following the end of the applicable quarter. |

| Penalties for Late Payment | If the return is postmarked after the due date, penalties and interest may apply based on the number of days late. |

| Form Version | The current version of the form is TXR-020.05, revised in June 2016. |

Fill out Common Forms

Nevada Assistance - Users can designate another person to apply for benefits on their behalf.

For those seeking guidance on the essential aspects of starting an LLC in Illinois, a thorough understanding of the operating agreement is vital. You can find a helpful resource that details the necessary components of an effective agreement in this Illinois operating agreement guide.

C4 Form Nevada - Officers are encouraged to review the NAC 289.240 guidelines closely when completing the AD-5 form to ensure compliance with state standards.