Blank Nevada Nucs 4072 PDF Template

The Nevada Nucs 4072 form is an essential document for employers in the state, designed to report quarterly contributions and wages. This form requires employers to provide critical information, including their employer account number, federal identification number, and total gross wages paid during the quarter. Employers must also indicate any changes that may affect their business, such as ownership changes or business discontinuation. Accurate reporting is crucial, as the form includes calculations for taxable wages and unemployment insurance amounts due. Additionally, it outlines penalties for late submissions, ensuring that employers are aware of potential fees. By understanding the components of the Nucs 4072 form, employers can maintain compliance with state regulations while managing their payroll responsibilities effectively.

Nevada Nucs 4072 Sample

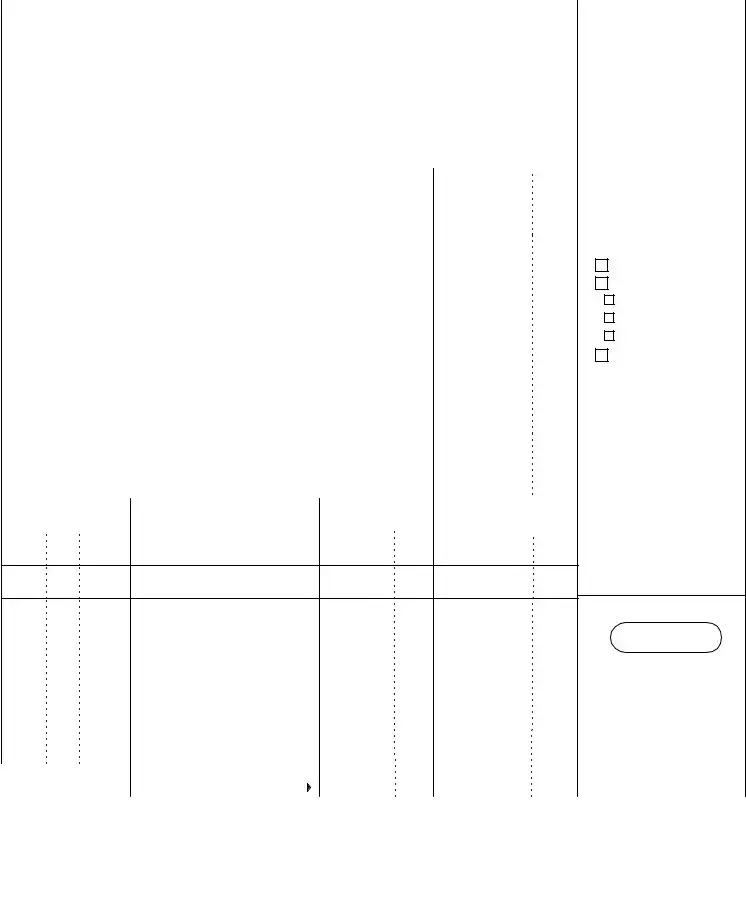

DO NOT STAPLE THIS FORM

State of Nevada

Department of Employment, Training & Rehabilitation

EMPLOYMENT SECURITY DIVISION

500 E. Third St., Carson City, NV

Telephone (775)

Page 1

EMPLOYER'S QUARTERLY CONTRIBUTION

AND WAGE REPORT

PLEASE CORRECT ANY NAME OR ADDRESS INFORMATION BELOW. |

1b. |

FOR QUARTER ENDING |

|

|

1e. |

|

FEDERAL I.D. NO. |

||||||||||

1a. EMPLOYER ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1c. |

DELINQUENT AFTER |

|

|

|

|

|

IMPORTANT |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR YOUR PROTECTION, VERIFY |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR FEDERAL I.D. NO. ABOVE. IF IT |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IS IN ERROR, PLEASE ENTER T H E |

||

|

|

|

|

|

|

|

|

1d. |

|

|

YOUR RATES |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORRECT NUMBER HERE: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A REPORT MUST BE FILED |

|||

3. TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER |

|

|

Dollars |

Cents |

INSTRUCTIONS ENCLOSED |

||||||||||||

|

|

|

|

|

|||||||||||||

(If you paid no wages, write "NONE," sign report and return.) |

(See Instructions) |

|

|

|

|

|

|

|

|||||||||

|

|

|

2. |

|

REPORT OF CHANGES |

||||||||||||

4. LESS WAGES IN EXCESS OF |

|

|

|

PER INDIVIDUAL |

|

|

|

|

|

If any of the following changes |

|||||||

(Cannot exceed amount in Item 3.) |

|

|

(See Instructions ) |

|

|

|

have occurred, please checkthe |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

appropriate box and provide |

|||

5. TAXABLE WAGES PAID THIS QUARTER (Item 3 less Item 4.) |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

details on page 2. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Discontinued |

6. UI AMOUNT DUE THIS QUARTER (Item 5 x your |

UI |

Rate shown in Item 1d.) |

|

|

|

|

|

|

|

|

Ownership Change |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entire Business Sold |

7. CEP AMOUNT DUE THIS QUARTER (Item 5 x the CEP Rate in Item 1d.) |

(Add) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Part of Business Sold |

|||||||||||

(Do not include the CEP amount on federal unemployment tax return Form 940.) |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Legal Ownership Change |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. PRIOR CREDIT (Attach "Statement of Employer Account" ) |

|

(Subtract) |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Business Added |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. CHARGE FOR LATE FILING OF THIS REPORT |

|

|

|

|

(Add) |

|

|

|

(FOR DIVISION USE ONLY) |

||||||||

(One or more days late add $5.00 forfeit.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. ADDITIONAL CHARGE FOR LATE FILING, AFTER 10 DAYS |

|

|

(Add) |

|

|

|

|

|

|

|

|||||||

(Item 5 x 1/10% (.001) for each month or part of month delinquent.) |

|

|

|

|

|

|

|

|

|

||||||||

11. INTEREST ON PAST DUE UI CONTRIBUTIONS |

|

|

|

|

(Add) |

|

|

|

|

|

|

|

|||||

(Item 6 x 1% (.01) for each month or part of month delinquent.) |

(See Instructions) |

|

|

|

|

|

|

|

|||||||||

12. TOTAL PAYMENT DUE (Total Items 6 through 11.) MAKE PAYABLE TO NEVADA |

|

|

|

|

|

|

|

||||||||||

EMPLOYMENT SECURITY DIVISION. Please enter Employer Account Number on check . |

|

|

|

|

|

|

|

||||||||||

13. SOCIAL SECURITY |

14. |

EMPLOYEE NAME |

|

15. |

TOTAL TIPS |

16. TOTAL GROSS |

|

|

|

|

|||||||

NUMBER |

Do not make adjustments to prior quarters . |

|

REPORTED |

WAGES INCLUDING TIPS |

|

|

|

||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

Dollars |

Cents |

Dollars |

Cents |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. NUMBER OF WORKERS |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

LISTED ON THIS REPORT |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. FOR EACH MONTH, |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

REPORT THE NUMBER OF |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

WORKERS WHO WORKED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

DURING OR RECEIVED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PAY FOR THE PAYROLL |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD WHICH INCLUDES |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

THE 12TH OF THE MONTH. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

1 MO |

|

|

2 MO |

|

3 MO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.TOTAL PAGES |

|

|

20. TOTAL TIPS AND TOTAL |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

THIS REPORT |

|

|

WAGES THIS PAGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. I certify that the information contained on this report and the attachments is true and correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

__________________________________________________________ |

_______________________________________________________________ |

|

|||||||||||||||||||

Signed/Title |

|

|

|

|

Name of Preparer if Other Than Employer |

|

|

|

|

|

|

|

|

||||||||

(______)________________________(______)___________________ |

(______)__________________________ ___________________________ |

|

|

||||||||||||||||||

Area Code Fax Number |

Area Code Telephone Number |

Area Code |

Telephone Number |

Date |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

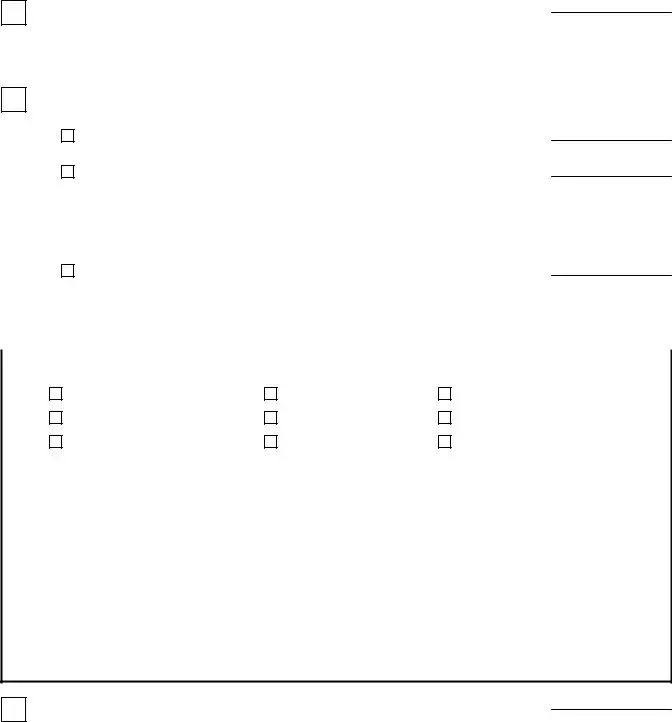

E M P L O Y E R ' S R E P O R T O F C H A N G E S

P a g e 2

E m p l o y e r A c c o u n t N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ T e l e p h o n e N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Business Discontinued (no new ownership) ..........................................................

M o n t h / D a y / Y e a r

( P l e a s e n o t i f y t h e D i v i s i o n i f , o r w h e n , b u s i n e s s r e s u m e s . )

E x a c t D a t e o f L a s t P a y r o l l _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

M o n t h / D a y / Y e a r

C h a n g e i n B u s i n e s s O w n e r s h i p - C o m p l e t e N E W O W N E R ( S ) s e c t i o n b e l o w .

Sale of Entire Business .............................................................................

M o n t h / D a y / Y e a r

Partial Sale (not out of business) ..............................................................

M o n t h / D a y / Y e a r

D e s c r i b e P a r t S o l d _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Change in Legal Ownership .....................................................................

( s u c h a s a d d i n g o r d r o p p i n g a p a r t n e r , i n c o r p o r a t i n g , e t c . )

M o n t h / D a y / Y e a r

N E W O W N E R ( S ) |

N e w F e d e r a l I d e n t i f i c a t i o n N u m b e r ( i f a p p l i c a b l e ) : |

|

|

|

|

|

|

C h e c k T y p e o f O r g a n i z a t i o n: |

|

|

|

S C o r p o r a t i o n |

S o l e P r o p r i e t o r |

L i m i t e d L i a b i l i t y P a r t n e r s h i p |

|

P u b l i c l y T r a d e d C o r p o r a t i o n |

A s s o c i a t i o n |

L i m i t e d L i a b i l i t y C o m p a n y |

|

P r i v a t e l y H e l d C o r p o r a t i o n |

P a r t n e r s h i p |

O t h e r |

|

N a m e a n d a d d r e s s o f n e w o w n e r ( s ) , p a r t n e r ( s ) , c o r p o r a t e o f f i c e r ( s ) , m e m b e r ( s ) , e t c . _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

R e m a r k s _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

New Business Units Added to Present Ownership .................................................

M o n t h / D a y / Y e a r

T r a d e N a m e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

L o c a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N a t u r e o f O p e r a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

P r e v i o u s O w n e r ( s ) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N U C S - 4 0 7 2 ( R e v . 9 - 0 2 )

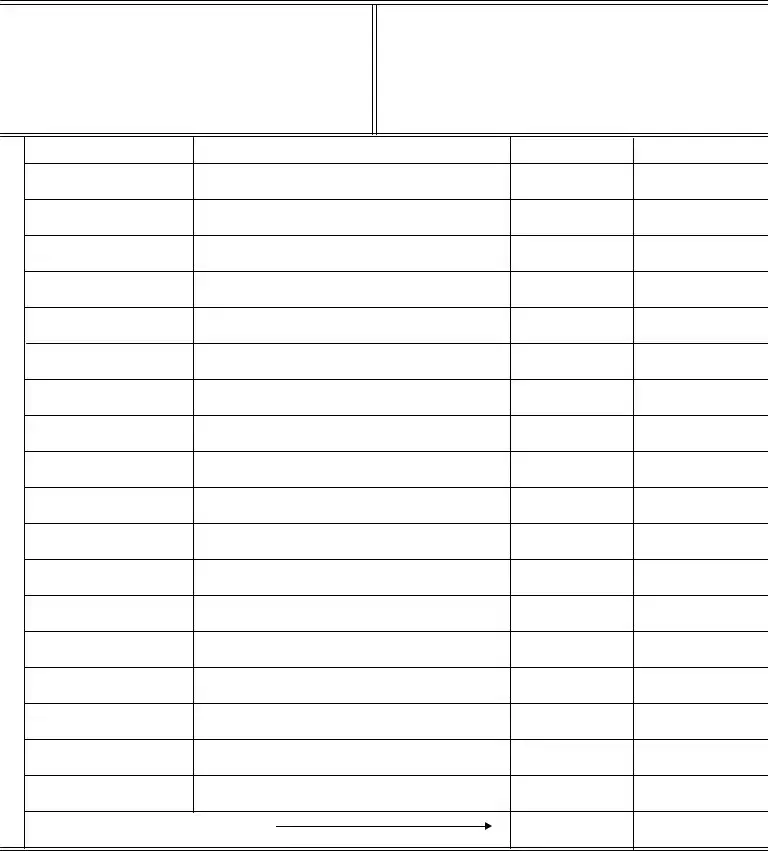

STATE OF NEVADA

DEPARTMENT OF EMPLOYMENT, TRAINING AND REHABILITATION

EMPLOYMENT SECURITY DIVISION

500 E. Third Street

Carson City, Nevada

CONTINUATION SHEET

EMPLOYER'S QUARTERLY LIST OF WAGES PAID

EMPLOYER ACCOUNT NUMBER

NAME

ADDRESS

FOR QUARTER ENDING |

PAGE NUMBER |

|

|

|

|

ENCLOSE THIS FORM WITH THE "EMPLOYER'S QUARTERLY CONTRIBUTION AND WAGE REPORT" (FORM

Report Not Complete if Social Security Numbers Are Missing

SOCIAL SECURITY NUMBER

EMPLOYEE'S NAM E

TOTAL TIPS REPORTED

THIS QUARTER

TOTAL WAGES (INCLUDING REPORTED TIPS) THIS QUARTER

TOTAL TIPS AND TOTAL WAGES THIS PAGE

$

$

File Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The Nevada Nucs 4072 form is used to report an employer's quarterly contribution and wage details to the state’s Employment Security Division. |

| Filing Requirement | Employers must file this report quarterly, even if no wages were paid during the period. If no wages were paid, the employer should write "NONE" and return the signed report. |

| Late Filing Penalties | A charge of $5.00 applies for reports filed one or more days late. Additional charges may accrue if the report is more than 10 days late. |

| Tax Calculation | The form calculates the Unemployment Insurance (UI) amount due based on taxable wages. This is derived from the total gross wages minus any excess wages reported. |

| Governing Laws | This form is governed by Nevada Revised Statutes (NRS) Chapter 612, which outlines the state's unemployment compensation laws. |

| Employer Verification | Employers must verify their Federal Identification Number (EIN) on the form. If incorrect, they should provide the correct number in the designated area. |

Fill out Common Forms

C4 Form Nevada - The AD-5 form bridges the gap between foundational training and intermediate recognition in a Nevada peace officer's career.

To gain insights into the Illinois Operating Agreement nuances, one can refer to the resourceful guide on essential aspects of an Operating Agreement here.

Nevada Taxation Department - The form is structured to guide filers through a logical progression from gross sales to net tax due, enhancing clarity.

How to Get a Work Permit in Nevada - All information requested on the form must be provided, ensuring accuracy and completeness.